Short answers long answers : Solutions of Questions on Page Number : 172

Q1: State the meaning of financial statement analysis?

Answer: A critical and thorough examination of the financial statements of a company in order to understand the data contained in it, is known as ‘Financial Statement Analysis‘. It helps in identifying and understanding the financial strengths and weaknesses of a business so that financial results can be drawn.

Q2:What are limitations of financial statement analysis?

Answer: Limitations of financial statement are given below.

1. Ignores Changes in the Price level

The financial analysis fails to capture the change in price level. The figures of different years are taken on nominal values and not in real terms (i.e. not taking price change into considerations).

2. Misleading and Wrong Information

The financial analysis fails to reveal the change in the accounting procedures and practices. Consequently they may provide wrong and misleading information.

3. Interim and Final Picture

The financial analysis presents only the interim report and thereby provides incomplete information. They fail to provide the final and holistic picture.

4. Ignores Qualitative and Non-monetary Aspects

The financial analysis reveals only the monetary aspects. In other words, these analyses consider only that information that can be expressed only in monetary terms. These analyses fail to disclose managerial efficiency, growth prospects, and other non-operational efficiency of a business.

Q3:List any three objectives of analysing financial statement?:

Answer:

Objectives of Financial Statements

The following are the various objectives for preparing financial statements.

It enables the conduct of meaningful comparisons of financial data. It provides better and easy understanding of the changes in the financial data overtime.

It helps in designing effective plans and better execution of plans by enabling control and checks over the use of the financial resources.

Analysis of Financial Statements helps to know the earning capacity and profitability of a business firm. It also measures the efficiency of the business operations.

Q4:State the importance of financial statements to

(i) shareholders

(ii) creditors

(iii) government

(iv) investors

Answer:Importance of financial statements to its various users is given below.

(i) Shareholders– They are interested in assessing the profitability and viability of the capital invested by them in the business. The financial statements prepared by the business concerns enable them to have sufficient information to assess the financial performance and financial health of the business.

(ii) Creditors– These are those individuals and organisations to whom a business owes money on account of credit purchases of goods and services. Hence, the creditors require information about the credit worthiness and liquidity position of the business.

(iii) Government– It needs information to determine various macroeconomic variables such as national income, GDP, industrial growth, etc. The accounting information assist the government in the formulation of various policies measures and to address various economic problems such as unemployment, poverty, etc

(iv) Investors– These are the parties who have invested or are planning to invest in the business of an enterprise. Hence, in order to assess the viability and prospects of their investments, they need information about the profitability and solvency position of the business

Q5: How will you disclose the following items in the Balance Sheet of a company:

(i) Loose Tools

(ii) Uncalled liability on partly paid-up shares

(iii) Debentures Redemption Reserve

(iv) Mastheads and publishing titles

(v) 10% debentures

(vi) Proposed dividends

(vii) Share forfeited account

(viii) Capital Redemption Reserve

(ix) Mining Rights

(x) Work-in-progress

Answer:

Disclosure of various items in the Balance Sheet of a company is given below.

|

Items |

Main Head |

Sub-Head |

|

|

(i) |

Loose Tools |

Current Assets |

Inventories |

|

(ii) |

Uncalled liability on partly paid-up shares |

Contingent Liability and Capital Commitments |

Capital Commitments |

|

(iii) |

Debentures Redemption Reserve |

Shareholders’ Funds |

Reserve and surplus |

|

(iv) |

Mastheads and publishing titles |

Non-Current Assets |

Fixed Assets – Intangible assets |

|

(v) |

10% debentures |

Non-Current Liabilities |

Long-Term Borrowings |

|

(vi) |

Proposed dividend |

Current Liabilities |

Short-Term Provisions |

|

(vii) |

Share forfeited account |

Shareholders’ Funds |

Subscribed Capital (to be added) |

|

(viii) |

Capital Redemption Reserve |

Shareholders’ Funds |

Reserve and surplus |

|

(ix) |

Mining Rights |

Non-Current Assets |

Fixed Assets – Intangible assets |

|

(x) |

Work-in-progress |

Current Assets |

Inventories |

Q6 :Explain the nature of the financial statements.

Answer : The financial statements are the end-products of the accounting process. The financial statements not only reveal the true financial position of the company but also help various accounting users in decision making and policy designing process. The nature of the financial statements depends upon the following aspects like recorded facts, conventions, concepts, and personal judgment

1. Recorded facts- The items recorded in the financial statements reflect their original cost i.e. the cost at which they were acquired. Consequently, financial statements do not reveal the current market price of the items. Further, financial statements fail to capture the inflation effects.

2. Conventions- The preparation of financial statements is based on some accounting conventions like, Prudence Convention, Materiality Convention, Matching Concept, etc. The adherence to such accounting conventions makes financial statements easy to understand, comparable and reflects the true and fair financial position of the company.

3. Accounting Assumptions – These basic accounting assumptions like Going Concern Concept, Money Measurement Concept, Realisation Concept, etc are called as postulates. While preparing financial statements, certain postulates are adhered to. The nature of these postulates is reflected in the nature of the financial statements.

4. Personal Judgments- Personal value judgments play an important role in deciding the nature of the financial statements. Different judgments are attached to different practices of recording transactions in the financial statements. For example, recording stock either at market value or at the cost requires value judgment. Similarly, provision on various assets, method of charging depreciation, period related to writing off intangible assets depends on personal judgment. Thus, personal judgments determine the nature of the financial statements to a great extent.

Q7:Explain in detail about the significance of the financial statements.

Answer : The importance of financial statements is mentioned below.

1. Provides Information- Financial statements provide information to various accounting users both internal as well as external users. It acts as a basic platform for different accounting users to derive information according to varying needs. For example, the financial statements on one hand help the shareholders and investors in assessing the viability and return on their investments, while on the other hand, the financial statements help the tax authorities in calculating the amount of tax liability of the company.

2. Cash Flow- Financial statements provide information about the cash flows of the company. The financial statements help the creditors and other investors in determining solvency of company.

3. Effectiveness of Management- The comparability feature of the financial statements enables management to undertake comparisons like inter-firm and intra-firm comparisons. This not only helps in assessing the viability and performance of the business but also helps in designing policies and drafting policies. The financial statements enhance the effectiveness and efficacy of the management.

4. Disclosure of Accounting Policies- Financial statements provide information about the various policies, important changes in the methods, practices and process of accounting by the company. The disclosure of the accounting policies makes financial statements simple, true and enables different accounting users to understand without any ambiguity.

5. Policy Formation by Government- It needs information to determine national income, GDP, industrial growth, etc. The accounting information assist the government in the formulation of various policy measures and to address various economic problems like employment, poverty etc.

6. Attracts Investors and Potential Investors- They invest or plan to invest in the business. Hence, in order to assess the viability and prospectus of their investment, creditors need information about profitability and solvency of the business.

Q8 :Explain the limitations of financial statements.

Answer : The following are the limitations of financial statements.

1. Historical Data- The items recorded in the financial statements reflect their original cost i.e. the cost at which they were acquired. Consequently, financial statements do not reveal the current market price of the items. Further, financial statements fail to capture the inflation effects.

2. Ignorance of Qualitative Aspect- Financial statements does not reveal the qualitative aspects of a transaction. The qualitative aspects like colour, size and brand position in the market, employee’s qualities and capabilities are not disclosed by the financial statements.

3. Biased- Financial statements are based on the personal judgments regarding the use of methods of recording. For example, the choice of practice in the valuation of inventory, method of depreciation, amount of provisions, etc. are based on the personal value judgments and may differ from person to person. Thus, the financial statements reflect the personal value judgments of the concerned accountants and clerks.

4. Inter- firm Comparisons- Usually, it is difficult to compare the financial statements of two companies because of the difference in the methods and practices followed by their respective accountants.

5. Window dressing- The possibility of window dressing is probable. This might be because of the motive of the company to overstate or understate the assets and liabilities to attract more investors or to reduce taxable profit. For example, Satyam showed high fixed deposits in the Assets side of its Balance Sheet for better liquidity that gave false and misleading signals to the investors.

6. Difficulty in Forecasting- Since the financial statements is based on historical data, so they fail to reflect the effect of inflation. This drawback makes forecasting difficult.

Q9: Prepare the format of statement of Profit and Loss and explain its items.

Answer: Format of Statement of Profit and Loss As per the REVISED SCHEDULE VI

|

Statement of Profit and Loss for year ended… |

||||

|

S. No. |

Particulars |

Note No. |

Figures for the Current Year |

Figures for the Previous Year |

|

I |

Revenue from Operations |

|||

|

II |

Other Income |

|||

|

III |

Total Revenue (I + II) |

|||

|

IV |

Expenses: |

|||

|

Cost of Material Consumed |

||||

|

Purchase of Stock-in-Trade |

||||

|

Changes in inventories of finished goods |

||||

|

Work-in-progress and Stock-in-Trade |

||||

|

Employee Benefit Expenses |

||||

|

Finance Cost |

||||

|

Depreciation and Amortisation Expenses |

||||

|

Other Expenses |

||||

|

Total Expenses |

||||

|

V |

Profit before exceptional and extraordinary items and tax (III – IV) |

|||

|

VI |

Exceptional items |

|||

|

VII |

Profit before extraordinary item and tax (V – VI) |

|||

|

VIII |

Extraordinary Items |

|||

|

IX |

Profit Before Tax (VII – VIII) |

|||

|

X |

Tax Expenses |

|||

|

(1) Current Tax |

||||

|

(2) Deferred Tax |

||||

|

XI |

Profit/(Loss) for period from continuing operations (IX – X) |

|||

|

XII |

Profit/ (Loss) from discontinuing operations |

|||

|

XIII |

Tax expenses of discontinuing operations |

|||

|

XIV |

Profit/(Loss) from discontinuing operations (after Tax (XII – XIII) |

|||

|

XV |

Profit (Loss) for the period (XI + XIV) |

|||

|

XVI |

Earning Per Equity Shares |

|||

|

(1) Basic |

||||

|

(2) Diluted |

||||

I. Revenue from Operations- It refers to the revenue earned from the basic operating business activities of an organization. For Non-financing companies, it consists of the following.

Sale of Products

Sale of Services

Other Operating Revenues

For financing companies, revenue from operations includes the following

Interest

Dividends

Other Financial Services

II. Other Incomes– This income includes the income earned other than from the operating activities of a business. It comprised of the following incomes.

Interest Income (in case of Non-Financing Company)

Dividend Income (in case of Non-Financing Company)

Net Gain or Loss on Sale of Investments

Other Non-Operating Incomes (i.e. after deducting expenses directly related to such income)

III. Expenses- These can be bifurcated in the following given below types.

Cost of Materials Consumed- It includes all the materials consumed during the process of manufacturing. It can also be calculated with the help of the given below formula.

Material Consumed = Opening Stock of Raw Material + Purchase of Raw Material – Closing Stock of Raw Material

Purchase of Stock-in-Trade- It includes all the goods purchased by a trading concern with an intention of resell.

Change in Inventories, Work-in-Progress and Stock-in-Trade- It is difference of opening and closing balance of inventories (stock), work-in-progress and stock-in-trade.

Q10 : Prepare the format of balance sheet and explain the various elements of balance sheet.

Answer:

COMPANY’S BALANCE SHEET- As per REVISED SCHEDULE VI

|

Name of the Company… BALANCE SHEET as at… |

|||

|

Particulars |

Note No. |

Figures as at the end of Current Year |

Figures as at the end of the Previous Year |

|

I. EQUITY AND LIABILITIES |

|||

|

(1) Shareholders’ Funds |

|||

|

(a) Share Capital |

|||

|

(b) Reserves and Surplus |

|||

|

(c) Money received against Share Warrants |

|||

|

(2) Share Application Money Pending Allotment |

|||

|

(3) Non-Current Liabilities |

|||

|

(a) Long-Term Borrowings |

|||

|

(b) Deferred Tax Liabilities (Net) |

|||

|

(c) Other Long-Term Liabilities |

|||

|

(d) Long-Term Provisions |

|||

|

(4) Current Liabilities |

|||

|

(a) Short-Term Borrowings |

|||

|

(b) Trade Payables |

|||

|

(c) Other Current Liabilities |

|||

|

(d) Short-Term Provision |

|||

|

TOTAL |

|||

|

II. ASSETS |

|||

|

(1) Non-Current Assets |

|||

|

(a) Fixed Assets |

|||

|

(i) Tangible Assets |

|||

|

(ii) Intangible Assets |

|||

|

(iii) Capital Work-in-Progress |

|||

|

(iv) Intangible assets under development |

|||

|

(b) Non-Current Investments |

|||

|

(c) Deferred tax assets (net) |

|||

|

(d) Long-Term Loans and Advances |

|||

|

(e) Other Non-Current Assets |

|||

|

(2) Current Assets |

|||

|

(a) Current Investments |

|||

|

(b) Inventories |

|||

|

(c) Trade Receivables |

|||

|

(d) Cash and Cash Equivalents |

|||

|

(e) Short-Term Loans and Advances |

|||

|

(f) Other Current Assets |

|||

|

TOTAL |

|||

Items under the head Equity and Liabilities

1. Shareholders’ Funds

Share Capital:

Authorised Capital-

Issued Share Capital-

Subscribed Share Capital-

Called-up Share Capital-

Paid-up Share Capital-

Share Forfeiture Amount

Reserves and Surplus: It consists of the following items to be shown separately.

Capital Reserve

Capital Redemption Reserve

Securities Premium

Debenture Redemption Reserve

Revaluation Reserve

Other Reserves (such as General Reserve, Tax reserve, etc.)

Proposed Additions to Reserves

Sinking Fund

Share Option Outstanding Amount

Surplus i.e. credit balance in Statement of Profit and Loss. However, in case of debit balance in Statement of Profit and Loss, it is deducted from the total of reserves.

Money received against warrants: A financial instrument that allows its holder to acquire equity shares is known as Share Warrant. Any amount received by the company on such share warrants is required to be disclosed under this head.

2. Share Application Money Pending Allotment

Amount received by the company on application of shares issued and the allotment on which is to be received after the date of balance sheet is shown under this head separately.

3. Non-Current Liabilities

These are comprised of the following items.

Long-Term Borrowings- It is further consists of the given below items.

Debentures

Bonds

Term Loans from bank as well as from other parties

Deposits

Other Loans and Advances

Deferred Tax Liabilities (Net)

Other Long-Term Liabilities

Long-Term Provisions

4. Current Liabilities

Under this head the following items are disclosed .

Short-term Liabilities- It is further comprised of the given below items.

Loan repayable on demands from bank as well as from other parties

Deposits

Other Loans and Advances

Trade Payables

Other Current Liabilities- It includes all those liabilities that are not covered in any of the mentioned above heads. Some examples are-

Income received in advance

Interest accrued but not due on borrowings

Unpaid Dividends

Calls-in-Advance and interest thereon

Other Payables etc.

Short-term Provisions- These are categorised as follows.

Provision for Doubtful Debts

Proposed Dividend

Provision for Tax

Provision for Employees Benefits

Others

Items under the head Assets

Non-Current Assets and Current Assets are two titles that come under the heading of Assets.

1. Non-Current Assets

Fixed Assets- These are further classified s follows.

Tangible Assets (such as, Building, Machinery, Furniture, etc.)

Intangible Assets (such as Goodwill, Trademark, Copyrights, Mining Rights, etc.)

Capital Work-in-Progress

Intangible Assets under development

Intangible Assets under development

Deferred Tax Assets

Long-term Loans and Advance

Other Non-Current Assets

2. Current Assets

Under this head the following items are shown.

Current Investments- Investments that are held for conversion into cash within a period of 12 months. These are further classified as follows

Investment in Equity Shares

Investment in Preference Shares

Investment in Government or Trust Securities

Investment in Debentures or Bonds

Investment in Mutual Funds

Investment in Partnership Firms

Other Investments

Inventories- It comprised of the given items .

Raw Materials

Work-in-Progress

Finished Goods

Stock-in-Trade (goods acquired for trading)

Stores and Spares

Loose Tools

Trade Receivables

Cash and Cash Equivalents- These are classified as follows.

Cash on Hand

Balances with Banks

Cheques, Drafts on Hand

Others

Short-term Loans and Advances

Other Current Assets (such as prepaid expenses, advance taxes, etc.)

Q11 :Explain how financial statements are useful to the various parties who are interested in the affairs of an undertaking?

Answer :

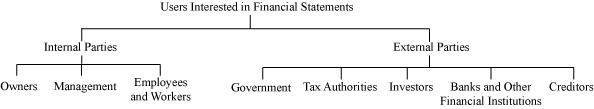

The various parties that are directly or indirectly interested in the financial statements of a company can be categorized into the following two categories:

1. Internal parties

2. External parties

Internal Parties

The following are the various internal accounting users who are directly related to the company.

1. Owner- The owner/s is/are interested in the profit earned or loss incurred during an accounting period. They are interested in assessing the profitability and viability of the capital invested by them in the business.

2. Management- The financial statements help the management in drafting various policies measures, facilitating planning and decision making process. The financial statements also enable management to exercise various cost controlling measures and to remove inefficiencies.

3. Employees and workers- They are interested in the timely payment of wages and salaries, bonus and appropriate increment in their wages and salaries. With the help of the financial statements they can know the amount of profit earned by the company and can demand reasonable hike in their wages and salaries.

External Parties

There are various external users of accounting who need accounting information for decision making, investment planning and to assess the financial position of the business. The various external users are given below.

1. Banks and other financial institutions- Banks provide finance in the form of loans and advances to various businesses. Thus, they need information regarding liquidity, creditworthiness, solvency and profitability to advance loans.

2. Creditors- These are those individuals and organisations to whom a business owes money on account of credit purchases of goods and receiving services; hence, the creditors require information about credit worthiness of the business.

3. Investors and potential investors- They invest or plan to invest in the business. Hence, in order to assess the viability and prospectus of their investment, creditors need information about profitability and solvency of the business.

4. Tax authorities- They need information about sales, revenues, profit and taxable income in order to determine the levy various types of tax on the business.

5. Government- It needs information to determine national income, GDP, industrial growth, etc. The accounting information assist the government in the formulation of various policies measures and to address various economic problems like employment, poverty etc.

6. Researchers- Various research institutes like NGOs and other independent research institutions like CRISIL, stock exchanges, etc. undertake various research projects and the accounting information facilitates their research work.

7. Consumers- Every business tries to build up reputation in the eyes of consumers, which can be created by the supply of better quality products and post-sale services at reasonable and affordable prices. Business that has transparent financial records, assists the customers to know the correct cost of production and accordingly assess the degree of reasonability of the price charged by the business for its products and ,thus, helps in repo building of the business.

8. Public- Public is keenly interested to know the proportion of the profit that the business spends on various public welfare schemes; for example, charitable hospitals, funding schools, etc. This information is also revealed by the profit and loss account and balance sheet of the business.

Q12 : `Financial statements reflect a combination of recorded facts, accounting conventions and personal judgments’ discuss.

Answer :

The financial statements are the end-products of the accounting process. The financial statements not only reveal the true financial position of the company but also help various accounting users in decision making and policy designing process. The nature of the financial statements depends upon the following aspects like recorded facts, conventions, concepts, and personal judgment

1. Recorded facts- The items recorded in the financial statements reflect their original cost i.e. the cost at which they were acquired. Consequently, financial statements do not reveal the current market price of the items. Further, financial statements fail to capture the inflation effects.

2. Conventions- The preparation of financial statements is based on some accounting conventions like, Prudence Convention, Materiality Convention, Matching Concept, etc. The adherence to such accounting conventions makes financial statements easy to understand, comparable and reflects the true and fair financial position of the company.

3. Accounting Assumptions – These basic accounting assumptions like Going Concern Concept, Money Measurement Concept, Realisation Concept, etc are called as postulates. While preparing financial statements, certain postulates are adhered to. The nature of these postulates is reflected in the nature of the financial statements.

4. Personal Judgments- Personal value judgments play an important role in deciding the nature of the financial statements. Different judgments are attached to different practices of recording transactions in the financial statements. For example, recording stock either at market value or at the cost requires value judgment. Similarly, provision on various assets, method of charging depreciation, period related to writing off intangible assets depends on personal judgment. Thus, personal judgments determine the nature of the financial statements to a great extent.

Q13 : Explain the process of preparing income statement and balance sheet.

Answer:

The process of preparing Income Statement (now Statement of Profit and Loss) as per Revised Schedule VI is explained below in a chronological order.

1. Prepare a Trial Balance on the basis of the balances of various accounts in the ledger.

2. Record Revenue from Operations i.e. Sales less Sales Return.

3. Add Other Incomes to Revenue from Operations (such as profit on sale of assets, cash discount received etc.) to ascertain Total Revenue.

4. Deduct all the expenses incurred by the company from Total Revenue (such as cost of material consumed, finance cost, depreciation and amortisation etc.) to ascertain Profit before Tax.

5. Deduct Tax paid by the company from Profit before Tax to ascertain the Profit or loss for the period.

The process of preparing Balance Sheet as per the Revised Schedule VI is explained below in a chronological order.

As per the this schedule, the Balance Sheet is prepared in vertical format and divided into two parts i.e. (i) Equity and Liabilities and (ii) Assets

1. Under the head Equity and Liabilities: Shareholders’ Funds, Share Application Money Pending Allotment, Non-Current Liabilities and Current Liabilities are recorded.

2. After recording Equity and Liabilities, Assets are recorded. Under this head all the Non-Current Assets (such as Tangible and Intangible Assets, Capital Work-in-Progress etc.) and Current Assets (such as Inventories, Trade Receivables, Current Investment etc.) are recorded.

3. At the end, total of two heads is ascertained, which must be equal.

Q14:Show the following items in the balance sheet as per the provisions of the companies Act, 1956 in (Revised) Schedule VI:

| Particulars | Rs. | Particulars | Rs. |

| Preliminary Expenses | 2,40,000 | Good will | 30,000 |

| Discount on issue of shares | 20,000 | Loose tools | 12,000 |

| 10% Debentures | 2,00,000 | Motor Vehicles | 4,75,000 |

| Stock in Trade | 1,40,000 | Provision for tax | 16,000 |

| Cash at bank | 1,35,000 | ||

| Bills receivable | 1,20,000 |

Answer:

|

Extract of Balance Sheet as at March 31, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a. Share Capital |

||

|

b. Reserves and Surplus |

||

|

2. Non-Current Liabilities |

||

|

1 |

2,00,000 |

|

3. Current Liabilities |

||

|

||

| b. Short-term Provisions |

2 |

16,000 |

|

II. Assets |

||

|

1. Non-Current Assets |

||

|

||

| i. Tangible Assets |

3 |

4,75,000 |

| ii. Intangible Assets |

4 |

30,000 |

| b. Non-Current Investments | ||

|

2. Current Assets |

||

|

5 |

1,52,000 |

| b. Trade Receivables |

6 |

1,20,000 |

| c.Cash and Cash Equivalents |

7 |

1,35,000 |

| d. Other Current Assets |

8 |

2,60,000 |

|

Notes to Accounts |

|||

|

Particulars |

Amount (Rs) |

||

|

1. Long Term Borrowings |

|||

|

10% Debentures |

2,00,000 |

||

|

2. Short Term Provisions |

|||

|

Provision for Tax |

16,000 |

||

|

3. Tangible Assets |

|||

|

Motor Vehicles |

4,75,000 |

||

|

4. Intangible Assets |

|||

|

Goodwill |

30,000 |

||

|

5. Inventory |

|||

|

Loose Tools |

12,000 |

||

|

Stock |

1,40,000 |

1,52,000 |

|

|

1,52,000 |

|||

|

6. Trade Receivables |

|||

|

Bill Receivable |

1,20,000 |

||

|

7. Cash and Cash equivalents |

|||

|

Cash at Bank |

1,35,000 |

||

|

8. Other Current Assets |

|||

|

Preliminary Expenses |

2,40,000 |

||

|

Discount on Issue of Shares |

20,000 |

2,60,000 |

|

|

2,60,000 |

|||

Q15: On 1st Aril, 2013, Jumbo Ltd. issued 10,000; 12% debentures of Rs. 100 each a discount of 20%, redeemable after 5 years. The company decided to write-off discount on issue of such debentures over the life time of the Debentures. Show the items in the balance sheet of the company immediately after the issue of these debentures.

Answer:

|

Balance Sheet as at April 01, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a. Share Capital |

||

|

b. Reserves and Surplus |

||

|

2. Non-Current Liabilities |

||

| a. Long-term Borrowings |

1 |

10,00,000 |

|

3. Current Liabilities |

||

| a. Other Current Liabilities | ||

| b. Short-term Provisions | ||

|

Total |

10,00,000 |

|

|

II. Assets |

||

|

1. Non-Current Assets |

||

| a. Other Non-Current Assets |

2 |

1,60,000 |

|

2. Current Assets |

||

| a. Other Current Assets |

3 |

40,000 |

| b. Cash and Cash Equivalents |

4 |

8,00,000 |

|

Total |

10,00,000 |

|

|

Notes to Accounts |

|

|

Particulars |

Amount (Rs) |

|

1. Long Term Borrowings |

|

|

12% Debentures |

10,00,000 |

|

2.Other Non-current assets |

|

|

Unamortized discount on issue of Debentures |

1,60,000 |

|

3. Other Current Assets |

|

|

Unamortized discount on issue of Debentures |

40,000 |

|

4. Cash and Cash Equivalents |

|

|

Bank |

8,00,000 |

Q16:From the following information prepare the balance sheet of Gitanjali Ltd., as per the (Revised) Schedule VI:

Inventories Rs. 14,00,000; Equity Share Capital Rs. 20,00,000; Plant and Machinery Rs. 10,00,000; Preference Share Capital Rs. 12,00,000; Debenture Redemption Reserve Rs. 6,00,000; Outstanding Expenses Rs. 3,00,000; Proposed Dividend Rs. 5,00,000; Land and Building Rs. 20,00,000; Current Investments Rs. 8,00,000; Cash Equivalent Rs. 10,00,000; Short term loan from Zaveri Ltd. (A Subsidiary Company of Twilight Ltd.) Rs. 4,00,000; Public Deposits Rs. 12,00,000.

Answer:

|

Balance Sheet as at March 31, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a. Share Capital |

1 |

32,00,000 |

|

b. Reserves and Surplus |

2 |

6,00,000 |

|

2. Non-Current Liabilities |

||

| a. Long-term Borrowings |

3 |

12,00,000 |

|

3. Current Liabilities |

||

| a. Other Current Liabilities |

4 |

3,00,000 |

| b. Short-term Borrowings |

5 |

4,00,000 |

| c. Short-term Provisions |

6 |

5,00,000 |

|

Total |

62,00,000 |

|

|

II. Assets |

||

|

1. Non-Current Assets |

||

| a. Fixed Assets | ||

| i. Tangible Assets |

7 |

30,00,000 |

| ii. Intangible Assets | ||

| b. Non-Current Investments | ||

|

2. Current Assets |

||

| a. Inventories |

14,00,000 |

|

| b. Current Investments |

8,00,000 |

|

| c. Cash and Cash Equivalents |

10,00,000 |

|

|

Total |

62,00,000 |

|

|

Notes to Accounts |

|||

|

Particulars |

Amount (Rs) |

||

|

1. Share Capital |

|||

|

Equity Share Capital |

20,00,000 |

||

|

Preference Share Capital |

12,00,000 |

32,00,000 |

|

|

32,00,000 |

|||

|

2.Reserve and Surplus |

|||

|

Debenture Redemption Reserve |

6,00,000 |

||

|

3. Long-term Borrowings |

|||

|

Public Deposits |

12,00,000 |

||

|

4. Other Current Liabilities |

|||

|

Outstanding Expenses |

3,00,000 |

||

|

5. Short-term Borrowings |

|||

|

Loan from Zaveri Ltd. |

4,00,000 |

||

|

6. Short-Term Provisions |

|||

|

Proposed Dividend |

5,00,000 |

||

|

7. Tangible Assets |

|||

|

Land and Building |

20,00,000 |

||

|

Plant and Machinery |

10,00,000 |

30,00,000 |

|

|

30,00,000 |

|||

|

Notes to Accounts |

||||

|

Particulars |

Amount (Rs) |

|||

|

1. Share Capital |

|

|||

|

Equity Share Capital |

16,00,000 |

|

||

|

Preference Share Capital |

6,00,000 |

22,00,000 |

||

|

|

22,00,000 |

|||

|

|

|

|||

|

2.Reserve and Surplus |

|

|||

|

General Reserve |

6,00,000 |

|||

|

|

|

|||

|

3. Long Term Borrowings |

|

|||

|

12% Debentures |

12,00,000 |

|||

|

|

|

|||

|

4. Trade Payables |

|

|||

|

Creditors |

2,00,000 |

|

||

|

Bills Payable |

1,50,000 |

3,50,000 |

||

|

|

3,50,000 |

|||

|

|

|

|||

|

5. Short-Term Provisions |

|

|||

|

Provision for Taxation |

2,50,000 |

|||

|

|

|

|||

|

6. Tangible Assets |

|

|||

|

Land and Building |

16,00,000 |

|

||

|

Plant and Machinery |

8,00,000 |

24,00,000 |

||

|

|

24,00,000 |

|||

|

|

|

|||

|

7. Cash and Cash Equivalents |

|

|||

|

Bank |

5,00,000 |

|||

|

|

|

|||

Q17: From the following information prepare the balance sheet of Jam Ltd. as per the (revised) Schedule VI:

Inventories Rs. 7,00,000; Equity Share Capital Rs. 16,00,000; Plant and Machinery Rs. 8,00,000; Preference Share Capital Rs. 6,00,000; General Reserves Rs. 6,00,000; Bills payable Rs. 1,50,000; Provision for taxation Rs. 2,50,000; Land and Building Rs. 16,00,000; Noncurrent Investments Rs. 10,00,000; Cash at Bank Rs. 5,00,000;Creditors Rs. 2,00,000; 12% Debentures Rs. 12,00,000.

Answer:

|

Balance Sheet as at March 31, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a. Share Capital |

1 |

22,00,000 |

|

b. Reserves and Surplus |

2 |

6,00,000 |

|

2. Non-Current Liabilities |

||

| a. Long-term Borrowings |

3 |

12,00,000 |

|

3. Current Liabilities |

||

| a. Short-term Borrowings | ||

| b. Trade Payables |

4 |

3,50,000 |

| c. Short-term Provisions |

5 |

2,50,000 |

|

Total |

46,00,000 |

|

|

II. Assets |

||

|

1. Non-Current Assets |

||

| a. Fixed Assets | ||

| i. Tangible Assets |

6 |

24,00,000 |

| b. Non-Current Investments |

10,00,000 |

|

|

2. Current Assets |

||

| a. Inventories |

7,00,000 |

|

| b. Cash and Cash Equivalents |

7 |

5,00,000 |

|

Total |

46,00,000 |

|

Q19: Prepare the balance sheet of Jyoti Ltd. as at March 31, 2013 from the following information as per provisions of (Revised) Schedule VI of the companies Act, 1956:

Building Rs. 10,00,000; Investments in the shares of Metro Tyers Rs. 3,00,000; Stores & Spares Rs. 1,00,000; Discount on issue of 10% debentures Rs. 10,000; Statement of Profit and Loss (Dr.) Rs. 90,000; 5,00,000 Equity Shares of Rs. 20 each fully paid-up; Capital Redemption Reserve Rs. 1,00,000; 10% Debentures Rs. 3,00,000; Unpaid dividends Rs. 90,000; Share options outstanding account Rs. 10,000.

Answer:

|

Balance Sheet as at March 31, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a. Share Capital |

1 |

10,00,000 |

|

b. Reserves and Surplus |

2 |

10,000 |

|

2. Non-Current Liabilities |

||

|

3 |

3,00,000 |

|

3. Current Liabilities |

||

|

4 |

1,00,000 |

|

Total |

14,10,000 |

|

|

II Assets |

||

|

1. Non-Current Assets |

||

| a. Fixed Assets | ||

| i. Tangible Assets |

5 |

10,00,000 |

| b. Non-Current Investments |

6 |

3,00,000 |

|

2. Current Assets |

||

| a. Inventories |

7 |

1,00,000 |

| b. Other Current Assets |

8 |

10,000 |

|

Total |

14,10,000 |

|

|

Notes to Accounts |

|||

|

Particulars |

Amount (Rs) |

||

|

1.Share Capital |

|||

|

Equity Share Capital (50,000* shares of Rs 20 each) |

10,00,000 |

||

|

2.Reserve and surplus |

|||

|

Capital Redemption Reserve |

1,00,000 |

||

|

Less: Statement of Profit or Loss (Debit) |

90,000 |

10,000 |

|

|

10,000 |

|||

|

3. Long-term Borrowings |

|||

|

10% Debentures |

3,00,000 |

||

|

4. Other Current Liabilities |

|||

|

Unpaid Dividend |

90,000 |

||

|

Share Option Outstanding |

10,000 |

1,00,000 |

|

|

1,00,000 |

|||

|

5. Tangible Assets |

|||

|

Building |

10,00,000 |

||

|

6. Non-Current Investments |

|||

|

Shares of Metro Tyres |

3,00,000 |

||

|

7. Inventory |

|||

|

Stores and Spares |

1,00,000 |

||

|

8. Other Current Assets |

|||

|

Discount on Issue of 10% Debentures |

10,000 |

||

Q20: Brinda Ltd. has furnished the following information:

(a) 25,000, 10% debentures of Rs. 100 each;

(b) Bank Loan of Rs. 10,00,000 repayable after 5 years;

(c) Interest on debentures is yet to be paid.

Show the above items in the balance sheet of the company as at March 31, 2013.

Answer:

|

Extract of Balance Sheet as at March 31, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a Share Capital |

||

|

b. Reserves and Surplus |

||

|

2. Non-Current Liabilities |

||

|

1 |

35,00,000 |

|

3. Current Liabilities |

||

|

2 |

2,50,000 |

|

Notes to Accounts |

||

|

Particulars |

Amount (Rs) |

|

|

1. Long Term Borrowings |

||

|

12% Debentures |

25,00,000 |

|

|

Bank Loan |

10,00,000 |

35,00,000 |

|

35,00,000 |

||

|

2. Other Current Liabilities |

||

|

Interest on Debentures |

2,50,000 |

|

Q21: Prepare a balance sheet of Black Swan Ltd., as at March 31, 2013 as per the provisions of Schedule VI of the companies Act, 1956 form the following information:

| General Reserve | : | 3,000 |

| 10% Debentures | : | 3,000 |

| Statement of Profit & Loss | : | 1,200 |

| Depreciation on fixed assets | : | 700 |

| Gross Block | : | 9,000 |

| Current Liabilities | : | 2,500 |

| Preliminary Expenses | : | 300 |

| 6% Preference Share Capital | : | 5,000 |

| Cash & Cash Equivalents | : | 6,100 |

Answer:

|

Extract of Balance Sheet as at March 31, 2013 |

||

|

Particulars |

Note No. |

Amount (Rs) |

|

I. Equity and Liabilities |

||

|

1. Shareholders’ Funds |

||

|

a. Share Capital |

1 |

5,000 |

|

b. Reserves and Surplus |

2 |

4,200 |

|

2. Non-Current Liabilities |

||

| a. Long-term Borrowings |

3 |

3,000 |

|

3. Current Liabilities |

2,500 |

|

|

Total |

14,700 |

|

|

II. Assets |

||

|

1. Non-Current Assets |

||

| a. Fixed Assets | ||

| i. Tangible Assets |

4 |

8,300 |

|

2. Current Assets |

||

| a. Cash and Cash Equivalents |

5 |

6,100 |

| b. Other Current Assets |

6 |

300 |

|

Total |

14,700 |

|

|

Notes to Accounts |

|||

|

Particulars |

Amount (Rs) |

||

|

1. Share Capital |

|||

|

6% Preference Share Capital |

5,000 |

||

|

2.Reserve and Surplus |

|||

|

General Reserve |

3,000 |

||

|

Statement of Profit or Loss |

1,200 |

4,200 |

|

|

4,200 |

|||

|

3.Long Term Borrowings |

|||

|

10% Debentures |

3,000 |

||

|

4. Tangible Assets |

|||

|

Fixed Assets |

9,000 |

||

|

Less: Depreciation |

700 |

8,300 |

|

|

8,300 |

|||

|

5.Cash and Cash Equivalents |

|||

|

Cash |

6,100 |

||

|

6. Other Current Assets |

|||

|

Preliminary Expenses |

300 |

||