Short answers : Solutions of Questions on Page Number : 217

Q1 :State the meaning of a Trial Balance?

Answer :

Trial Balance is a statement prepared with debit and credit balances of all accounts in ledger, to verify the arithmetical accuracy of the accounts. It is prepared after balancing all the accounts of ledger. There are two columns in a Trial Balance: debit and credit. While debit side includes all the debit balances, credit side includes all the credit balances of the accounts. It also helps in preparing financial statements, as it is a summarise version of the ledger. It is generally prepared on monthly or yearly basis.

Q2 :Give two examples of errors of principle?

Answer : ‘Errors of principle’ refer to those errors that are committed when recording of transactions is done against the accounting principle. Below given are the examples of error of principle

1. Wages paid for construction of building debited to Wages Account

In this transaction, wages paid for the construction of building is a capital expenditure and accordingly building account should have been debited. However, in this case, it is treated as revenue expenditure and is debited to Wages Account. This error violates the accounting principle.

2. Amount spent on repair of machinery debited to Machinery Account

In this transaction, amount of repair is a revenue expenditure and not a capital expenditure. It should have been debited as ‘Repairs’, but was wrongly debited to the Machinery Account.

Q3 :Give two examples of errors of commission?

Answer :

Errors of Commission refer to those errors that are committed when transactions are recorded with wrong amounts; wrong balancing or wrong posting and/or wrong carrying forwarding is done. Below given are the examples of error of commission.

Goods purchased worth Rs 20,000 on credit are recorded in the Purchases Book as Rs 10,000.

This transaction should have been recorded in the Purchases Book with an amount of Rs 20,000; however, it was recorded as Rs 10,000. This is an error due to wrong recording of amount.

Total of Sales Book is carried forward as Rs 5,000 instead of Rs 500.

In this case, wrong amount is carried forwarded from one accounting period to another or from an end of one page to the beginning of another page. This is referred to as an error of carrying forward.

NCERT Solutions for Class 11 Accountancy Financial Accounting Part-1 Chapter 6 – Trial Balance and Rectification of Errors

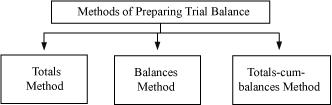

Q4 :What are the methods of preparing trial balance?

Answer :

Below are diagrammatically explained methods to prepare Trial Balance.

Let us understand these methods of preparing Trial Balance with the help of an abstract account of Mr. A.

|

Mr. |

|||||||||||||

| Dr. |

Cr. |

||||||||||||

|

2011 |

2011 |

||||||||||||

|

Apr.1 |

Balance b/d |

50,000 |

Apr.7 |

Cash |

30,000 |

||||||||

|

Apr.3 |

Sales |

20,000 |

Apr.8 |

Sales Return |

20,000 |

||||||||

|

Apr.10 |

Sales |

40,000 |

Apr.16 |

Bank |

50,000 |

||||||||

|

Apr.30 |

Balance c/d |

10,000 |

|||||||||||

|

1,10,000 |

1,10,000 |

||||||||||||

Totals method: According to the Totals method, the total of debit and credit sides of an account is shown in the debit and credit columns of the Trial Balance. If the total of the debit column and the total of credit column of Trial Balance are equal, then the Trial Balance is said to agree, otherwise not.

For example, in the above example, the total of the debit side of Mr. A Account, i.e., Rs 1,10,000 is shown in the debit column of the Trial Balance and the total of the credit side of Mr. A Account, i.e., Rs 1,10,000 is shown in the credit column of the Trial Balance. The total of debit column and the total of the credit column of the Trial Balance are equal to each other.

|

Trial Balance as on April 30, 2011 |

|||

|

Accounts |

L.F. |

Debit Total Rs |

Credit Total Rs |

| Mr. A’s Account |

1,10,000 |

1,00,000 |

|

Balance method: According to the Balance method, the balance of ledger accounts is shown in the debit and credit column of the Trial Balance. The balance of ledger may be either debit balance or credit balance. In the former case, the debit side of an account exceeds its credit side; whereas, in the latter case the credit side exceeds the debit side of the account. The sum total of the balances in the debit column of the Trial Balance must be equal to the sum total of the balances in the credit columns of the Trial Balance. It is a commonly used method.

For example, Mr A’s account shows a debit balance of Rs 10,000, as the total of the debit side (Rs 1,10,000) exceeds the total of the credit side (Rs 1,00,000). The debit balance of Rs 10,000 will be shown in the debit column of the Trial Balance.

|

Trial Balance as on April 30, 2011 |

||||

|

Accounts |

L.F. |

Debit Balance Rs |

Credit Balance Rs |

|

| Mr. A’s Account |

10,000 |

|||

Total cum balance method: It is a combination of both of the above methods, i.e., Totals method and Balance method.

|

Trial Balance as on April 30, 2011 |

||||||

|

Accounts |

L.F. |

Debit Total Rs |

Credit Total Rs |

Debit Balance Rs |

Credit Balance Rs |

|

| Mr. A’s Account |

1,10,000 |

1,00,000 |

10,000 |

|||

Q5 :What are the steps taken by an accountant to locate the errors in the trial balance?

Answer : The following are various steps that an accountant takes to locate the errors in the Trial Balance.

Re-totalling of the debit and the credit columns of the Trial Balance to locate the difference in the total of both the columns.

Checking whether any account is omitted to be recorded with the exact difference amount.

Half the difference, then check whether any amount is posted in the wrong column of the Trial Balance.

Divide the difference by 9, if it is completely divisible, it is an error of transposition of figure, i.e. 546 is written as 645.

If there exist differences especially of Rs 1, Rs 10, Rs 100, Rs 1000, etc., it suggests that the casting of Subsidiary Books should be checked once again.

If difference still exists and it is not possible to detect the reason for the difference, then for the time being, the difference is transferred in the suspense account in order to proceed further. Otherwise, a complete checking is suggested.

Q6 :What is a suspense account? Is it necessary that suspense account will balance off after rectification of the errors detected by the accountant? If not, then what happens to the balance still remaining in suspense account?

Answer : When Trial Balance does not agree, i.e., when the total of the debit column does not match that of the credit column, then the difference of the Trial Balance is transferred to a temporary account in order to avoid delay in preparation of the financial statements. This temporary account is termed as Suspense Account. If the debit column falls short of the credit column, then the Suspense Account is debited and if the credit column falls short of the debit column then the Suspense Account is credited.

If all the errors are detected and rectified, then the Suspense Account automatically gets closed (i.e. becomes zero). However, if still there exists any difference, then it should be transferred to the Balance Sheet. If the Suspense Account shows a debit balance, then it is shown in the Assets side and if the Suspense Account shows a credit balance, then it is shown in the Liabilities side of the Balance Sheet.

Q7 :What kinds of errors would cause difference in the trial balance? Also list examples that would not be revealed by a trial balance?

Answer :

The errors that lead to the differences in the Trial Balance are termed as one-sided errors. These are those errors that affect only one account. Below are given the errors that cause differences in the Trial Balance.

Wrong casting of any account, this is termed as the error of casting.

Wrong carrying forward of the balances from previous year’s books or from one end of page to another. These types of errors are termed as the errors in carrying forward.

If entries are posted in the wrong side of accounts.

Posting of a wrong amount in account, this is termed as the error of posting.

If entries are recorded partially, i.e., the entries are not recorded completely, then due to the error of partial omission, Trial Balance does not agree.

Here are a few examples that would not be revealed in a Trial Balance:

Sales to Mr. X, omitted to be recorded in the Sales Day Book

Purchases made from Mukesh, recorded in Mahesh’s Account, who is an other creditor

Wages paid for construction of building, recorded in the Wages Accoun

Q8 :State the limitations of trial balance?

Answer :

If the Trial Balance agrees, then it should not be taken for granted, that there is absolutely no errors. In fact, there do exist some errors that are not revealed by a Trial Balance. Such ineffectiveness of the Trial Balance is termed as the limitations of Trial Balance. The various limitations of the Trial Balance are given below.

It does not assist to detect errors that arise if an entry is not recorded in the Journal. Such errors are termed as the Errors of Complete Omission.

If the effect of one error is cancelled by the effect of another error, then it cannot be ascertained by the Trial Balance. Such types of errors are termed as Compensatory Errors, which are rare to find.

If correct amount is posted in the correct side; however, in the wrong account and if wrong amount is posted in the wrong side, but in the correct account, then the Trial Balance fails to reflect these errors.

If there arises any error of principle, like capital expenditure mistakenly regarded as revenue expenditure or vice-versa, then such errors may not be revealed in form of mismatch between the two columns of the Trial Balance.

If any transaction is recorded wrongly in the books of original entry, then such mistakes lead to the errors of recording which are not revealed by Trial Balance.

Long answers : Solutions of Questions on Page Number : 218

Q1 :Describe the purpose for the preparation of trial balance.

Answer :

The important purposes for the preparation of Trial Balance are explained with the help of the following points.

Ascertaining the arithmetical accuracy- When the total of all debit balance accounts are equal to all credit balance accounts, it is assumed that at least posting from journal to the respective accounts is arithmetically correct.

Summarising the ledger accounts- Trial Balance acts as a consolidated statement, providing a comprehensive list of all the accounts. Thus, a Trial Balance provides a summarised version of each account.

Preparing final accounts- As the Trial Balance provides a summarised version of each account, so different accounts can be directly transferred to Trading, Profit and Loss Account, and Balance Sheet without referring to different ledgers.

Locating and rectifying errors- If the Trial Balance does not agree, it indicates the occurrence of arithmetical error, which can be easily located. However, Trial Balance only helps in locate and rectify arithmetical error and not other types of errors.

Q2 :Explain errors of principle and give two examples with measures to rectify them.

Answer :

Errors of Principle refer to those errors that are committed when recording of transactions in the original book of entry is done against the accounting principle. These errors are not reflected in the Trial Balance. These errors are committed when proper distinction is not made between capital expenditure and revenue expenditure, or vice versa or between capital income and revenue income or vice versa.

The following examples will illustrate the process of understanding and rectification of such errors.

Let us consider first example. Wages paid for construction of building are debited to Wages Account.

Wrong entry made is:

| Wages A/c | Dr. | |

| To Cash A/c | ||

| ( Wages paid in cash) | ||

In this case, Wages paid for the construction of building should be treated as a capital expenditure and accordingly should be debited to the building account. However, the Wages Account is wrongly debited. Thus,

the correct entry that should have been made is:

Building A/c

| Building A/c |

Dr. |

|

| To Cash A/c | ||

| (Wages paid for construction

of building) |

||

In order to rectify this error, the rectifying entry should be:

| Building A/c | Dr. | |

| To Wages A/c | ||

| (Wages paid for construction

of building was debited to Wages Account, now rectified) |

||

The second example of errors of principle is the sale of old machinery recorded as sales.

Wrong entry made:

| Cash A/c | Dr. | |

| To Sales A/c | ||

| (Sales of old machinery, recorded as sales) | ||

In this case, the sale of old machinery should not be recorded as sales; in fact the Machinery Account should be credited. Thus, the correct entry that should have been made is:

| Cash A/c |

Dr. |

|

| To Machinery A/c | ||

| (Old machinery sold for cash) | ||

In order to rectify this error, Sales Account will be debited, as it is wrongly credited and machinery will be credited, as it will not be recorded in the books. Thus, the rectifying entry will be:

| Sales A/c | Dr. | |

| To Machinery A/c | ||

| (Sale of old machinery recorded as sales, now rectified) | ||

Q3 :Explain the errors of commission and give two examples with measures to rectify them.

Answer :

Errors of commission refer to those errors that are committed when transactions are recorded with wrong amounts, wrong balancing is done, wrong posting and/or wrong carrying forwarded is done. The following examples will illustrate the process of understanding and rectification of such errors.

Let us consider the first example. Sales made to Mr. X of Rs10,000 recorded as 1,000 from invoice.In this case, Mr. X’s account has been debited with Rs 1,000 instead of Rs 10,000; hence, the error of commission is committed. This requires a further debit of Rs 9,000, in order to rectify this error of commission. This will be rectified by passing the following entry:

| Mr X’s A/c | Dr. |

9,000 |

||

| To Sales A/c |

9,000 |

|||

| (Goods sold to Mr X of Rs 10,000 was wrongly posted as Rs 1,000,now rectified) |

||||

Purchase book was undercast by Rs 10,000.

This error can be rectified in any of the following two stages:

a. If an error is located before preparing trial balance, then Rs 10,000 should be recorded in the debit side of Purchases Account.

b. If an error is located after preparing Trial Balance, then the following entry need to be recorded.

| Purchase A/c | Dr. |

10,000 |

||

| To Suspense A/c |

10,000 |

|||

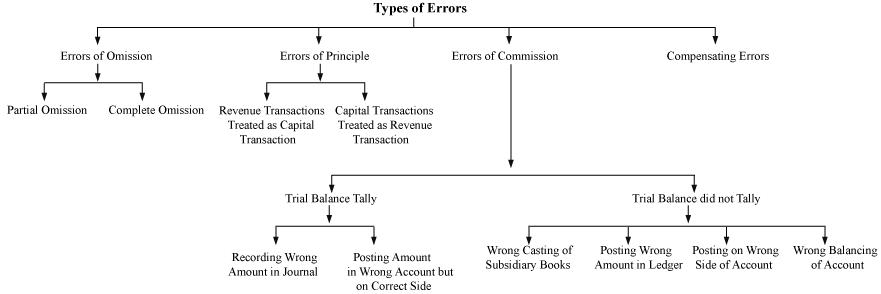

Q4 :What are the different types of errors that are usually committed in recording business transaction?

Answer :

Errors of omission- When an entry gets omitted during recording in the book of original entry or during posting the transaction, then error of omission is committed. There are two types of errors of omission, viz.:

Partial omission- When a transaction is correctly recorded in one side of account but is not recorded in the other side of the account. For example, goods sold to Mahesh recorded in sales but omitted to be recorded in Mahesh’s account. It affects the trial balance.

Complete omission- When a transaction gets completely omitted to be recorded in the books, then it is the case of complete omission . For example, transaction related to purchase of goods from Rakesh is not recorded in the purchases book. Such omissions does not affect the trial balance.

Errors of principle- These refer to those errors that are committed when recording of transactions in the book of the original entry is done against the accounting principle. These errors affect the trial balance.

These errors are committed when proper distinction is not made between revenue income or expenditure and capital income or expenditure. These are of two types:

When revenue transactions are treated as capital transactionsWhen capital transactions are treated as revenue transactions.For example, repairs made to machinery, recorded in machinery account.

Errors of commission- These refer to those errors that are committed when transactions are recorded with wrong amounts, wrong balancing, wrong posting and/or wrong carrying forwarded is done.

These are of two types:

Trial balance does not agree

When trial balance does not agree, then there exist one-sided errors that affect only one account and thereby are easily detectable. These one-sided errors exist due to the following reasons:

Wrong casting of subsidiary bookPosting wrong amount in ledgerPosting on the wrong side of accountWrong balancing of account

Trial balance agrees

When the trial balance agrees, then it should not be taken for granted that there are no errors, as the tallied trial balance just ensures the absence of arithmetical errors.These errors are not easily detectable; as these do not affect the trial balance. These errors arise due to:Recording wrong amount in the original book

Posting amount in the wrong account but in the correct side

Compensating errors- When effects of one error are cancelled by the effects of another error of an equal amount, then compensating errors are committed. For example, Mr. A’s account was credited by Rs 2,000 instead of 200 and Mr. B’s account was credited by Rs 200 instead of 2,000. In this case, the error in Mr. A’s account will be compensated by the error in Mr. B’s account

Q5 :As an accountant of a company, you are disappointed to learn that the totals in your new trial balance are not equal. After going through a careful analysis, you have discovered only one error. Specifically, the balance of the Office Equipment account has a debit balance of Rs. 15,600 on the trial balance. However, you have figured out that a correctly recorded credit purchase of pen-drive for Rs 3,500 was posted from the journal to the ledger with a Rs. 3,500 debit to Office Equipment and another Rs. 3,500 debit to creditors accounts. Answer each of the following questions and present the amount of any misstatement :

(a) Is the balance of the office equipment account overstated, understated, or correctly stated in the trial balance?

(b) Is the balance of the creditors account overstated, understated, or correctly stated in the trial balance?

(c) Is the debit column total of the trial balance overstated, understated, or correctly stated?

(d) Is the credit column total of the trial balance overstated, understated, or correctly stated?

(e) If the debit column total of the trial balance is Rs. 2,40,000 before correcting the error, what is the total of credit column.

Answer :

According to the given information, trial balance does not agree. Pen-drive is wrongly debited to office equipment account, instead of stationery account and supplier account is debited instead of crediting. Due to these mistakes, the following errors are committed:

The balance of office equipment is overstated by Rs 3,500.

The balance of creditors account is understated by Rs 7,000.

The total of the debit column of the trial balance is correctly stated.

The total of the credit column of the trial balance is understated by Rs 7,000.

If the total of the debit column of the trial balance is Rs 2,40,000 before rectifying error, the total of the credit column of the trial balance is Rs 2,33,000 (i.e., Rs 2,40,000 – Rs 7,000).

Numerical questions : Solutions of Questions on Page Number : 218

Q1 :Rectify the following errors:

(i)Credit sales to Mohan Rs 7,000 were not recorded.

(ii)Credit purchases from Rohan Rs 9,000 were not recorded.

(iii)Goods returned to Rakesh Rs 4,000 were not recorded.

(iv)Goods returned from Mahesh Rs 1,000 were not recorded.

Answer :

|

Journal |

|||||||||

|

S.No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

|||||

|

(i) |

Mohan |

Dr. |

7,000 |

||||||

|

To Sales A/c |

7,000 |

||||||||

|

(Goods sold to Mohan were |

|||||||||

|

(ii) |

Purchases A/c |

Dr. |

9,000 |

||||||

|

To Rohan |

9,000 |

||||||||

|

(Goods purchased to |

|||||||||

|

(iii) |

Rakesh |

Dr. |

4,000 |

||||||

|

To Purchases Return |

4,000 |

||||||||

|

(Goods returned to |

|||||||||

|

(iv) |

Sales Return A/c |

Dr. |

1,000 |

||||||

|

To Mahesh |

1,000 |

||||||||

|

(Goods returned from Mahesh |

|||||||||

Q2 :Rectify the following errors:

(i)Credit sales to Mohan Rs 7,000 were recorded as Rs 700.

(ii)Credit purchases from Rohan Rs 9,000 were recorded. as Rs 900.

(iii)Goods returned to Rakesh Rs 4,000 were recorded as Rs 400.

(iv)Goods returned from Mahesh Rs 1,000 were recorded as Rs 100.

Answer

|

Journal |

|||||||||||

|

S.No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

|||||||

|

(i) |

Mohan |

Dr. |

6,300 |

||||||||

|

To Sales A/c |

6,300 |

||||||||||

|

(Goods sold to Mohan Rs 7,000 now rectified) |

|||||||||||

|

(ii) |

Purchases A/c |

Dr. |

8,100 |

||||||||

|

To Rohan |

8,100 |

||||||||||

|

(Goods purchased from Rs 900, now |

|||||||||||

|

(iii) |

Rakesh |

Dr. |

3,600 |

||||||||

|

To Purchases Return |

3,600 |

||||||||||

|

(Goods returned to Rs 400, now rectified) |

|||||||||||

|

(iv) |

Sales Return A/c |

Dr. |

900 |

||||||||

|

To Mahesh |

900 |

||||||||||

|

(Goods returned from Mahesh recorded as Rs 100, now |

|||||||||||

Q3 :Rectify the following errors:

(i)Credit sales to Mohan Rs 7,000 were recorded as Rs 7,200.

(ii)Credit purchases from Rohan Rs 9,000 were recorded as Rs 9,900.

(iii)Goods returned to Rakesh Rs 4,000 were recorded as Rs 4,040.

(iv)Goods returned from Mahesh Rs 1,000 were recorded as Rs 1,600.

Answer

|

Journal |

||||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||||||

|

(i) |

Sales A/c |

Dr. |

200 |

|||||||

|

To Mohan |

200 |

|||||||||

|

(Goods sold to Mohan Rs 7,000 now rectified) |

||||||||||

|

(ii) |

Rohan |

Dr. |

900 |

|||||||

|

To Purchases A/c |

900 |

|||||||||

|

(Goods purchased from now rectified) |

||||||||||

|

(iii) |

Purchases Return A/c |

Dr. |

40 |

|||||||

|

To Rakesh |

40 |

|||||||||

|

(Goods returned to now rectified) |

||||||||||

|

(iv) |

Mahesh |

Dr. |

600 |

|||||||

|

To Sales Return A/c |

600 |

|||||||||

|

(Goods returned from Mahesh Rs 1,600, now |

||||||||||

Q4 : Rectify the following errors:

(a)Salary paid Rs 5,000 was debited to employee’s personal account.

(b)Rent Paid Rs 4,000 was posted to landlord’s personal account.

(c)Goods withdrawn by proprietor for personal use Rs 1,000 were debited to sundry expenses account.

(d)Cash received from Kohli Rs 2,000 was posted to Kapur’s account.

(e)Cash paid to Babu Rs 1,500 was posted to Sabu’s account.

Answer :

|

Journal |

|||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

|||||

|

(a) |

Salaries A/c |

Dr. |

5,000 |

||||||

|

To Employee |

5,000 |

||||||||

|

(Salary paid Rs 5,000 were personal Account, now |

|||||||||

|

(b) |

Rent A/c |

Dr. |

4,000 |

||||||

|

To Land Lord A/c |

4,000 |

||||||||

|

(Rent paid Rs 4,000 was now rectified) |

|||||||||

|

(c) |

Drawings A/c |

Dr. |

1,000 |

||||||

|

To Sundry Expenses A/c |

1,000 |

||||||||

|

(Goods drawn by proprietor Expenses Account, now |

|||||||||

|

(d) |

Kapur |

Dr. |

2,000 |

||||||

|

To Kohli |

2,000 |

||||||||

|

(Cash received from now rectified) |

|||||||||

|

(e) |

Babu |

Dr. |

1,500 |

||||||

|

To Sabu |

1,500 |

||||||||

|

(Cash paid to Babu was posted wrongly to Sabu’s Account, now rectified) |

|||||||||

Q5 :Rectify the following errors:

(a)Credit Sales to Mohan Rs 7,000 were recorded in purchases book.

(b)Credit Purchases from Rohan Rs 900 were recorded in sales book.

(c)Goods returned to Rakesh Rs 4,000 were recorded in the sales return book.

(d)Goods returned from Mahesh Rs 1,000 were recorded in purchases return book.

(e)Goods returned from Nahesh Rs 2,000 were recorded in purchases book.

Answer :

|

Journal |

|||||||||

|

S.No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

|||||

|

(a) |

Mohan |

Dr. |

14,000 |

||||||

|

To Sales A/c |

7,000 |

||||||||

|

To Purchases A/c |

7,000 |

||||||||

|

(Goods sold on credit to now rectified) |

|||||||||

|

(b) |

Sales A/c |

Dr. |

900 |

||||||

|

Purchases A/c |

Dr. |

900 |

|||||||

|

To Rohan |

1,800 |

||||||||

|

(Goods purchased from now rectified) |

|||||||||

|

(c) |

Rakesh |

Dr. |

8,000 |

||||||

|

To Purchases Return |

4,000 |

||||||||

|

To Sales Return A/c |

4,000 |

||||||||

|

(Goods returned to now rectified) |

|||||||||

|

(d) |

Sales Return A/c |

Dr. |

1,000 |

||||||

|

Purchases Return A/c |

Dr. |

1,000 |

|||||||

|

To Mahesh |

2,000 |

||||||||

|

(Goods returned from Mahesh Return Book, now |

|||||||||

|

(e) |

Sales Return A/c |

Dr. |

2,000 |

||||||

|

To Purchases A/c |

2,000 |

||||||||

|

(Goods returned from Mahesh Book, now rectified) |

|||||||||

Q6 :Rectify the following errors:

(a)Sales book overcast by Rs 700.

(b)Purchases book overcast by Rs 500.

(c)Sales return book overcast by Rs 300.

(d)Purchase return book overcast by Rs 200.

Answer :

|

Journal |

||||||||||

|

S.No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||||||

|

(a) |

Sales A/c |

Dr. |

700 |

|||||||

|

To Suspense A/c |

700 |

|||||||||

|

(Sales Book overcast by Rs |

||||||||||

|

(b) |

Suspense A/c |

Dr. |

500 |

|||||||

|

To Purchases A/c |

500 |

|||||||||

|

(Purchases Book overcast by |

||||||||||

|

(c) |

Suspense A/c |

Dr. |

300 |

|||||||

|

To Sales Return A/c |

300 |

|||||||||

|

(Sales Return Book overcast |

||||||||||

|

(d) |

Purchases Return A/c |

Dr. |

200 |

|||||||

|

To Suspense A/c |

200 |

|||||||||

|

(Purchases Return Book |

||||||||||

Q7 : Rectify the following errors :

(a)Sales book undercast by Rs 300.

(b)Purchases book undercast by Rs 400.

(c)Return Inwards book undercast by Rs 200.

(d)Return outwards book undercast by Rs 100.

Answer :

|

Journal |

||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||||

|

(a) |

Suspense A/c |

Dr. |

|

300 |

||||

|

|

To Sales A/c |

|

300 |

|||||

|

(Sales Book undercast by Rs 300, now |

|

|||||||

|

|

|

|||||||

|

(b) |

Purchases A/c |

Dr. |

|

400 |

||||

|

|

To Suspense A/c |

|

400 |

|||||

|

(Purchases Book undercast by Rs 400, now |

|

|||||||

|

|

|

|||||||

|

(c) |

Return Inwards A/c |

Dr. |

|

200 |

||||

|

To Suspense A/c |

|

200 |

||||||

|

(Return Inwards Book |

|

|||||||

|

|

||||||||

|

(d) |

Suspense A/c |

Dr. |

|

100 |

||||

|

To Return Outwards A/c |

|

100 |

||||||

|

(Return Outwards Book |

|

|||||||

|

|

|

|

|

|||||

Q8 :Rectify the following errors and ascertain the amount of difference in trial balance by preparing suspense account:(a)Credit sales to Mohan Rs 7,000 were not posted.

(b)Credit purchases from Rohan Rs 9,000 were not posted.

(c)Goods returned to Rakesh Rs 4,000 were not posted.

(d)Goods returned from Mahesh Rs 1,000 were not posted.

(e)Cash paid to Ganesh Rs 3,000 was not posted.

(f)Cash sales Rs 2,000 were not posted.

Answer :

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||||||

|

(a) |

Mohan |

Dr. |

7,000 |

|||||||

|

To Suspense A/c |

7,000 |

|||||||||

|

(Goods sold on credit to Mohan’s Account, now |

||||||||||

|

(b) |

Suspense A/c |

Dr. |

9,000 |

|||||||

|

To Rohan |

9,000 |

|||||||||

|

(Goods purchased from Rohan’s Account, now rectified) |

||||||||||

|

(c) |

Rakesh |

Dr. |

4,000 |

|||||||

|

To Suspense A/c |

4,000 |

|||||||||

|

(Goods returned to Rakesh’s Account, now rectified) |

||||||||||

|

(d) |

Suspense A/c |

Dr. |

1,000 |

|||||||

|

To Mahesh |

1,000 |

|||||||||

|

(Goods return from Mahesh recorded in Mahesh’s Account, |

||||||||||

|

(e) |

Ganesh |

Dr. |

3,000 |

|||||||

|

To Suspense A/c |

3,000 |

|||||||||

|

(Cash paid to Ganesh was not posted to Ganesh’s Account , now |

||||||||||

|

(f) |

Suspense A/c |

Dr. |

2,000 |

|||||||

|

To Sales A/c |

2,000 |

|||||||||

|

(Cash receipts from sale, was Account, now |

||||||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(b) |

Rohan |

9,000 |

(a) |

Mohan |

7,000 |

||

|

(d) |

Mahesh |

1,000 |

(c) |

Rakesh |

4,000 |

||

|

(f) |

Sales |

2,000 |

(e) |

Ganesh |

3,000 |

||

|

Balance c/d |

2,000 |

||||||

|

|

|

|

|

|

|||

|

|

14,000 |

|

|

14,000 |

|||

|

|

|

|

|

|

|||

Note: In order to match the balance of suspense account, it has been assumed that all errors given in the question are errors of partial omission.

Q9 :Rectify the following errors and ascertain the amount of difference in trial balance by preparing suspense account:

(a)Credit sales to Mohan Rs 7,000 were posted as Rs 9,000.

(b)Credit purchases from Rohan Rs 9,000 were posted as Rs 6,000.

(c)Goods returned to Rakesh Rs 4,000 were posted as Rs 5,000.

(d) Goods returned from Mahesh Rs 1,000 were posted as Rs 3,000.

(e)Cash sales Rs 2,000 were posted as Rs 200.

Answer :

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||

|

(a) |

Suspense A/c |

Dr. |

2,000 |

|||

|

To Mohan |

2,000 |

|||||

|

(Sold goods to Mohan Rs 7,000 now rectified) |

||||||

|

(b) |

Suspense A/c |

Dr. |

3,000 |

|||

|

To Rohan |

3,000 |

|||||

|

(Purchased goods from as Rs 6,000, now |

||||||

|

(c) |

Suspense A/c |

Dr. |

1,000 |

|||

|

To Rakesh |

1,000 |

|||||

|

(Goods returened to Rakesh Rs 4,000 wrongly posted Rs 5,000, now |

||||||

|

(d) |

Mahesh |

Dr. |

2,000 |

|||

|

To Suspense A/c |

2,000 |

|||||

|

(Goods returned from Mahesh now rectified) |

||||||

|

(e) |

Suspense A/c |

Dr. |

1,800 |

|||

|

To Sales A/c |

1,800 |

|||||

|

(Goods sold for cash Rs 2,000 now rectified) |

||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(a) |

Mohan |

2,000 |

(d) |

Mahesh |

2,000 |

||

|

(b) |

Rohan |

3,000 |

|||||

|

(c) |

Rakesh |

1,000 |

|||||

|

(e) |

Sales |

1,800 |

Balance c/d |

5,800 |

|||

|

|

|

|

|

||||

|

|

7,800 |

|

7,800 |

||||

|

|

|

|

|

||||

Note: In order to match answer with that of the answergiven in the book it has been assumed that all the errors mentioned in this question are errors of partial omission.

Q10 :Rectify the following errors :

(a)Credit sales to Mohan Rs 7,000 were posted to Karan.

(b)Credit purchases from Rohan Rs 9,000 were posted to Gobind.

(c)Goods returned to Rakesh Rs 4,000 were posted to Naresh.

(d)Goods returned from Mahesh Rs 1,000 were posted to Manish.

(e)Cash sales Rs 2,000 were posted to commission account.

Answer :

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||

|

(a) |

Mohan |

Dr. |

7,000 |

|||

|

To Karan |

7,000 |

|||||

|

(Goods sold to Mohan wrongly Account, now |

||||||

|

(b) |

Gobind |

Dr. |

9,000 |

|||

|

To Rohan |

9,000 |

|||||

|

(Goods purchased to Account, now |

||||||

|

(c) |

Rakesh |

Dr. |

4,000 |

|||

|

To Naresh |

4,000 |

|||||

|

(Goods returned to Account, now |

||||||

|

(d) |

Manish |

Dr. |

1,000 |

|||

|

To Mahesh |

1,000 |

|||||

|

(Goods returned from Mahesh posted in |

||||||

|

(e) |

Commission A/c |

Dr. |

2,000 |

|||

|

To Sales A/c |

2,000 |

|||||

|

(Goods sold for cash wrongly |

||||||

Q11 :Rectify the following errors assuming that a suspense account was opened.

Ascertain the difference in trial balance.

(a)Credit sales to Mohan Rs 7,000 were posted to the credit of his account.

(b)Credit purchases from Rohan Rs 9,000 were posted to the debit of his account as Rs 6,000.

(c)Goods returned to Rakesh Rs 4,000 were posted to the credit of his account.

(d)Goods returned from Mahesh Rs 1,000 were posted to the debit of his account as Rs 2,000.

(e)Cash sales Rs 2,000 were posted to the debit of sales account as Rs 5,000.

Answer :

|

Journal |

||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||

|

(a) |

Mohan |

Dr. |

14,000 |

|||

|

To Suspense A/c |

14,000 |

|||||

|

(Goods sold to Mohan wrongly now rectified) |

||||||

|

(b) |

Suspense A/c |

Dr. |

15,000 |

|||

|

To Rohan |

15,000 |

|||||

|

(Goods purchased from Rohan, debited to Rohan’s Account as |

||||||

|

(c) |

Rakesh |

Dr. |

8,000 |

|||

|

To Suspense A/c |

8,000 |

|||||

|

(Goods returened to Rakesh account, now |

||||||

|

(d) |

Suspense A/c |

Dr. |

3,000 |

|||

|

To Mahesh |

3,000 |

|||||

|

(Goods returned from Mahesh his account as Rs 2,000, now |

||||||

|

(e) |

Suspense A/c |

Dr. |

7,000 |

|||

|

To Sales A/c |

7,000 |

|||||

|

(Goods sold for cash for Rs Account as Rs 5,000, now |

||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(b) |

Rohan |

15,000 |

(a) |

Mohan |

14,000 |

||

|

(d) |

Mahesh |

3,000 |

(c) |

Rakesh |

8,000 |

||

|

(e) |

Sales |

7,000 |

Balance |

3,000 |

|||

|

|

|

||||||

|

|

25,000 |

|

25,000 |

||||

|

|

|

|

|

||||

Q12 :Rectify the following errors assuming that a suspense account was opened.

Ascertain the difference in trial balance.

(a)Credit sales to Mohan Rs 7,000 were posted to Karan as Rs 5,000.

(b)Credit purchases from Rohan Rs 9,000 were posted to the debit of Gobind as Rs 10,000.

(c)Goods returned to Rakesh Rs 4,000 were posted to the credit of Naresh as Rs 3,000.

(d)Goods returned from Mahesh Rs 1,000 were posted to the debit of Manish as Rs 2,000.

(e)Cash sales Rs 2,000 were posted to commission account as Rs 200.

Answer :

|

Journal |

||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||

|

(a) |

Mohan |

Dr. |

7,000 |

|||

|

To Karan |

5,000 |

|||||

|

To Suspense A/c |

2,000 |

|||||

|

(Goods sold to Mohan Rs 7,000 Karan’s Account as Rs 5,000, |

||||||

|

(b) |

Suspense A/c |

Dr. |

19,000 |

|||

|

To Rohan |

9,000 |

|||||

|

To Gobind |

10,000 |

|||||

|

(Goods returned from to Gobind’s Account as Rs 10,000, now |

||||||

|

(c) |

Rakesh |

Dr. |

4,000 |

|||

|

Naresh |

Dr. |

3,000 |

||||

|

To Suspense A/c |

7,000 |

|||||

|

(Goods returned to Naresh’s Account Rs 3,000, now rectified) |

||||||

|

(d) |

Suspense A/c |

Dr. |

3,000 |

|||

|

To Mahesh |

1,000 |

|||||

|

To Manish |

2,000 |

|||||

|

(Goods returned from Mahesh Manish’s Account as Rs 2,000, |

||||||

|

(e) |

Commission A/c |

Dr. |

200 |

|||

|

Suspense A/c |

Dr. |

1,800 |

||||

|

To Sales A/c |

2,000 |

|||||

|

(Cash sales Rs 2,000 posted as Rs 200, now |

||||||

Q13 :Rectify the following errors assuming that suspense account was opened.

Ascertain the difference in trial balance.

(a)Credit sales to Mohan Rs 7,000 were recorded in Purchase Book. However, Mohan’s account was correctly debited.

(b)Credit purchases from Rohan Rs 9,000 were recorded in sales book. However, Rohan’s account was correctly credited.

(c)Goods returned to Rakesh Rs 4,000 were recorded in sales return book. However, Rakesh’s account was correctly debited.

(d)Goods returned from Mahesh Rs 1,000 were recorded through purchases return book. However, Mahesh’s account was correctly credited.

(e)Goods returned to Naresh Rs 2,000 were recorded through purchases book. However, Naresh’s account was correctly debited.

Answer :

|

Journal |

||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||||

|

(a) |

Suspense A/c |

Dr. |

|

14,000 |

|

|||

|

|

|

To Sales A/c |

|

7,000 |

||||

|

|

|

To Purchases A/c |

|

7,000 |

||||

|

|

(Goods sold to Mohan however, Mohan’s Account was |

|

|

|||||

|

|

|

|

|

|||||

|

(b) |

Purchases A/c |

Dr. |

|

9,000 |

|

|||

|

|

Sales A/c |

Dr. |

|

9,000 |

|

|||

|

|

|

To Suspense A/c |

|

18,000 |

||||

|

|

(Purchased goods from However, Rohan’s Account was correctly credited, |

|

|

|||||

|

|

|

|

|

|||||

|

(c) |

Suspense A/c |

Dr. |

|

8,000 |

|

|||

|

|

To Purchases Return |

|

|

4,000 |

||||

|

|

To Sales Return A/c |

|

|

4,000 |

||||

|

|

(Goods returned to Sales Return Book; however, debited, now |

|

|

|

||||

|

|

|

|

|

|||||

|

(d) |

Sales Return A/c |

Dr. |

|

1,000 |

|

|||

|

|

Purchases Return A/c |

Dr. |

|

1,000 |

|

|||

|

|

To Suspense A/c |

|

|

2,000 |

||||

|

|

(Goods Returned from Mahesh Purchases Return Book; correctly credited, now |

|

|

|

||||

|

|

|

|

|

|||||

|

(e) |

Suspense A/c |

Dr. |

|

4,000 |

|

|||

|

|

To Purchases Return |

|

|

2,000 |

||||

|

To Purchases A/c |

|

|

2,000 |

|||||

|

(Goods returned to Book; however, correctly now rectified) |

|

|||||||

Q14 : Rectify the following errors:

(a)Furniture purchased for Rs 10,000 wrongly debited to purchases account.

(b)Machinery purchased on credit from Raman for Rs 20,000 was recorded through purchases book.

(c)Repairs on machinery Rs 1,400 debited to machinery account.

(d)Repairs on overhauling of secondhand machinery purchased Rs 2,000 was debited to Repairs account.

(e)Sale of old machinery at book value of Rs 3,000 was credited to sales account.

Answer :

|

Journal |

|||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

|||

|

(a) |

Furniture A/c |

Dr. |

10,000 |

||||

|

To Purchases A/c |

10,000 |

||||||

|

(Furniture purchased wrongly now rectified) |

|||||||

|

(b) |

Machinery A/c |

Dr. |

20,000 |

||||

|

To Purchases A/c |

20,000 |

||||||

|

(Machinery purchased from Purchases Book, now |

|||||||

|

(c) |

Repairs A/c |

Dr. |

1,400 |

||||

|

To Machinery A/c |

1,400 |

||||||

|

(Repair of machinery wrongly now rectified) |

|||||||

|

(d) |

Machinery A/c |

Dr. |

2,000 |

||||

|

To Repairs A/c |

2,000 |

||||||

|

(Overhauling of second hand debited in Repairs |

|||||||

|

(e) |

Sales A/c |

Dr. |

3,000 |

||||

|

To Machinery A/c |

3,000 |

||||||

|

(Machinery sold wrongly Account, now |

|||||||

Q15 :Rectify the following errors assuming that suspension account was opened.

Ascertain the difference in trial balance.

(a)Furniture purchased for Rs 10,000 wrongly debited to purchase account as Rs 4,000.

(b)Machinery purchased on credit from Raman for Rs 20,000 recorded through Purchases Book as Rs 6,000.

(c)Repairs on machinery Rs 1,400 debited to Machinery account as Rs 2,400.

(d)Repairs on overhauling of second hand machinery purchased Rs 2,000 was debited to Repairs account as Rs 200.

(e)Sale of old machinery at book value Rs 3,000 was credited to sales account as Rs 5,000.

Answer :

|

Journal |

|||||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

|||||||

|

(a) |

Furniture A/c |

Dr. |

10,000 |

||||||||

|

To Purchases A/c |

4,000 |

||||||||||

|

To Suspense A/c |

6,000 |

||||||||||

|

(Furniture purchased Rs Purchases Account as Rs |

|||||||||||

|

(b) |

Machinery A/c |

Dr. |

20,000 |

||||||||

|

To Purchases A/c |

6,000 |

||||||||||

|

To Raman |

14,000 |

||||||||||

|

(Machinery purchased Rs entered in Purchases |

|||||||||||

|

(c) |

Repairs A/c |

Dr. |

1,400 |

||||||||

|

Suspense A/c |

Dr. |

1,000 |

|||||||||

|

To Machinery A/c |

2,400 |

||||||||||

|

(Repair of machinery Rs 1,400 Machinery Account as Rs |

|||||||||||

|

(d) |

Machinery A/c |

Dr. |

2,000 |

||||||||

|

To Repairs A/c |

200 |

||||||||||

|

To Suspense A/c |

1,800 |

||||||||||

|

(Overhauling of second hand debited to Repairs |

|||||||||||

|

(e) |

Sales A/c |

Dr. |

5,000 |

||||||||

|

To Machinery A/c |

3,000 |

||||||||||

|

To Suspense A/c |

2,000 |

||||||||||

|

(Old machinery sold for Rs Account as Rs 5,000, |

|||||||||||

Q16 :Rectify the following errors :

(a)Depreciation provided on machinery Rs 4,000 was not posted.

(b)Bad debts written off Rs 5,000 were not posted.

(c)Discount allowed to a debtor Rs 100 on receiving cash from him was not posted.

(d)Discount allowed to a debtor Rs 100 on receiving cash from him was not posted to discount account.

(e)Bill receivable for Rs 2,000 received from a debtor was not posted.

Answer :

|

Journal |

||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||||

|

(a) |

Depreciation A/c |

Dr. |

4,000 |

|||||

|

To Machinery A/c |

4,000 |

|||||||

|

(Depreciation on machinery |

||||||||

|

(b) |

Bad debts A/c |

Dr. |

5,000 |

|||||

|

To Debtors A/c |

5,000 |

|||||||

|

(Bad debts written off were rectified) |

||||||||

|

(c) |

Discount Allowed A/c |

Dr. |

100 |

|||||

|

To Debtors A/c |

100 |

|||||||

|

(Discount allowed to debtors |

||||||||

|

(d) |

Discount Allowed A/c |

Dr. |

100 |

|||||

|

To Suspense A/c |

100 |

|||||||

|

(Discount allowed to debtors Account, now |

||||||||

|

(e) |

Bills Receivable A/c |

Dr. |

2,000 |

|||||

|

To Debtors A/c |

2,000 |

|||||||

|

(Bill receivable received now rectified) |

||||||||

Q17 : Rectify the following errors:

(a)Depreciation provided on machinery Rs 4,000 was posted as Rs 400.

(b)Bad debts written off Rs 5,000 were posted as Rs 6,000.

(c)Discount allowed to a debtor Rs 100 on receiving cash from him was posted as Rs 60.

(d)Goods withdrawn by proprietor for personal use Rs 800 were posted as Rs 300.

(e)Bill receivable for Rs 2,000 received from a debtor was posted as Rs 3,000.

Answer :

|

Journal |

|||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

|||||

|

(a) |

Depreciation A/c |

Dr. |

3,600 |

||||||

|

To Machinery A/c |

3,600 |

||||||||

|

(Depreciation provided on as Rs 400, now |

|||||||||

|

(b) |

Debtors A/c |

Dr. |

1,000 |

||||||

|

To Bad debt A/c |

1,000 |

||||||||

|

(Bad debt written off Rs now rectified) |

|||||||||

|

(c) |

Discount Allowed A/c |

Dr. |

40 |

||||||

|

To Debtors A/c |

40 |

||||||||

|

(Discount allowed to debtors now rectified) |

|||||||||

|

(d) |

Drawings A/c |

Dr. |

500 |

||||||

|

To Purchases A/c |

500 |

||||||||

|

(Drawings of goods Rs 800 now rectified) |

|||||||||

|

(e) |

Debtors A/c |

Dr. |

1,000 |

||||||

|

To Bills Receivable |

1,000 |

||||||||

|

(Bills receivable for 2,000 Rs 3,000) |

|||||||||

Q18 :Rectify the following errors assuming that suspense account was opened.

Ascertain the difference in trial balance.

(a)Depreciation provided on machinery Rs 4,000 was not posted to Depreciation account.

(b)Bad debts written-off Rs 5,000 were not posted to Debtors account.

(c)Discount allowed to a debtor Rs 100 on receiving cash from him was not posted to discount allowed account.

(d)Goods withdrawn by proprietor for personal use Rs 800 were not posted to Drawings account.

(e)Bill receivable for Rs 2,000 received from a debtor was not posted to Bills receivable account.

Answer :

|

Journal |

|||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

|||

|

(a) |

Depreciation A/c |

Dr. |

4,000 |

||||

|

To Suspense A/c |

4,000 |

||||||

|

(Depreciation on machinery Depreciation Account, now |

|||||||

|

(b) |

Suspense A/c |

Dr. |

5,000 |

||||

|

To Debtors A/c |

5,000 |

||||||

|

(Bad debts written off were now rectified) |

|||||||

|

(c) |

Discount Allowed A/c |

Dr. |

100 |

||||

|

To Suspense A/c |

100 |

||||||

|

(Discount allowed to Discount Allowed Account, now |

|||||||

|

(d) |

Drawings A/c |

Dr. |

800 |

||||

|

To Suspense A/c |

800 |

||||||

|

(Goods withdrawn by Account, now |

|||||||

|

(e) |

Bills Receivable A/c |

Dr. |

2,000 |

||||

|

To Suspense A/c |

2,000 |

||||||

|

(Bill Receivable received Bills Receivable Account, now |

|||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(b) |

Debtors |

5,000 |

(a) |

Depreciation |

4,000 |

||

|

(e) |

Discount |

100 |

|||||

|

(d) |

Drawing |

800 |

|||||

|

To Balance |

1,900 |

(e) |

Bills |

2,000 |

|||

|

6,900 |

6,900 |

||||||

Q19 :Trial balance of Anuj did not agree. It showed an excess credit of Rs 6,000.

He put the difference to suspense account. He discovered the following erro Rs

(a)Cash received from Ravish Rs 8,000 posted to his account as Rs 6,000.

(b)Returns inwards book overcast by Rs 1,000.

(c)Total of sales book Rs 10,000 was not posted to Sales account.

(d)Credit purchases from Nanak Rs 7,000 were recorded in sales Book. However, Nanak’s account was correctly credited.

(e)Machinery purchased for Rs 10,000 was posted to purchases account as Rs 5,000. Rectify the errors and prepare suspense account.

Answer :

|

Journal |

||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

||

|

(a) |

Suspense |

Dr. |

2,000 |

|||

|

To Ravish |

2,000 |

|||||

|

(Cash his |

||||||

|

(b) |

Suspense |

Dr. |

1,000 |

|||

|

To Return Inwards A/c |

1,000 |

|||||

|

(Return |

||||||

|

(c) |

Suspense |

Dr. |

10,000 |

|||

|

To Sales A/c |

10,000 |

|||||

|

(Total now |

||||||

|

(d) |

Purchases |

Dr. |

7,000 |

|||

|

Sales |

7,000 |

|||||

|

To Suspense A/c |

14,000 |

|||||

|

(Goods however, |

||||||

|

(e) |

Machinery |

Dr. |

10,000 |

|||

|

To Purchases A/c |

5,000 |

|||||

|

To Suspense A/c |

5,000 |

|||||

|

(Machinery Purchases |

||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

Balance |

6,000 |

(d) |

Purchases |

7,000 |

|||

|

(a) |

Ravish |

2,000 |

Sales |

7,000 |

|||

|

(b) |

Return |

1,000 |

(e) |

Machinery |

5,000 |

||

|

(c) |

Sales |

10,000 |

|||||

|

19,000 |

19,000 |

||||||

Q20 : Trial balance of Raju showed an excess debit of Rs 10,000. He put the difference to suspense account and discovered the following errors:

(a)Depreciation written-off the furniture Rs 6,000 was not posted to Furniture account.

(b)Credit sales to Rupam Rs 10,000 were recorded as Rs 7,000.

(c)Purchases book undercast by Rs 2,000.

(d)Cash sales to Rana Rs 5,000 were not posted.

(e)Old Machinery sold for Rs 7,000 was credited to sales account.

(f)Discount received Rs 800 from Kanan on playing cash to him was not posted. Rectify the errors and prepare suspense account.

Answer :

|

Journal |

|||||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

|||||||

|

(a) |

Suspense |

Dr. |

6,000 |

||||||||

|

To |

6,000 |

||||||||||

|

(Depreciation Furniture |

|||||||||||

|

(b) |

Rupam |

Dr. |

3,000 |

||||||||

|

To |

3,000 |

||||||||||

|

(Goods Rs 7,000, |

|||||||||||

|

(c) |

Purchases |

Dr. |

2,000 |

||||||||

|

To |

2,000 |

||||||||||

|

(Purchases |

|||||||||||

|

(d) |

Cash |

Dr. |

5,000 |

||||||||

|

To |

5,000 |

||||||||||

|

(Goods |

|||||||||||

|

(e) |

Sales |

Dr. |

7,000 |

||||||||

|

To |

7,000 |

||||||||||

|

(Sale now |

|||||||||||

|

(f) |

Kanan |

Dr. |

800 |

||||||||

|

To Discount |

800 |

||||||||||

|

(Discount now |

|||||||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(a) |

Furniture |

6,000 |

Balance |

10,000 |

|||

|

Balance |

6,000 |

(c) |

Purchases |

2,000 |

|||

|

12,000 |

12,000 |

||||||

Note: As per the solution, suspense account shows the credit balance of Rs 6,000. However, in the book the answer is credit balance of Rs 1,000. So, in order to match the answer with the book item (d) is taken as,Cash Sales to Rana Rs 5,000 were not posted to the sales account.Thus, the rectifying entry of this error will be:

| Suspense A/c | Dr.5,000 |

| To Sales A/c | 5,000 |

Q21 : Trial balance of Madan did not agree and he put the difference to suspense account. He discovered the following errors:

(a)Sales return book overcast by Rs 800.

(b)Purchases return to Sahu Rs 2,000 were not posted.

(c)Goods purchased on credit from Narula Rs 4,000 though taken into stock, but no entry was passed in the books.

(d)Installation charges on new machinery purchased Rs 500 were debited to sundry expenses account as Rs 50.

(e)Rent paid for residential accommodation of madam (the proprietor) Rs 1,400 was debited to Rent account as Rs 1,000.

Rectify the errors and prepare suspense account to ascertain the difference in trial balance.

Answer :

|

Journal |

|||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

|||||

|

(a) |

Suspense |

Dr. |

800 |

||||||

|

To |

800 |

||||||||

|

(Sales |

|||||||||

|

(b) |

Sahu |

Dr. |

2,000 |

||||||

|

To |

2,000 |

||||||||

|

(Goods |

|||||||||

|

(c) |

Purchases |

Dr. |

4,000 |

||||||

|

To |

4,000 |

||||||||

|

(Goods |

|||||||||

|

(d) |

Machinery |

Dr. |

500 |

||||||

|

To |

50 |

||||||||

|

To |

450 |

||||||||

|

(Installation Sundry |

|||||||||

|

(e) |

Drawings |

Dr. |

1,400 |

||||||

|

To Rent |

1,000 |

||||||||

|

To |

400 |

||||||||

|

(Rent 1,400, |

|||||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(a) |

Sales |

800 |

(d) |

Machinery |

450 |

||

|

Balance |

50 |

(e) |

Drawings |

400 |

|||

|

850 |

850 |

||||||

Note: As per the solution Suspense Account shows a credit balance of Rs 50. However, as per the answer given in the book, it is a credit balance of Rs 2050. In order to match answer with the book item (b) is taken as Purchases return to Sahu Rs 2,000 were not posted to Sahu’s Account. Thus, the rectifying entry for this error will be as:

| Sahu’s A/C | Dr.2000 |

| To Suspense A/c | 2000 |

Q22 :Trial balance of Kohli did not agree and showed an excess debit of Rs 16,300. He put the difference to a suspense account and discovered the following errors:

(a)Cash received from Rajat Rs 5,000 was posted to the debit of Kamal as Rs 6,000.

(b)Salaries paid to an employee Rs 2,000 were debited to his personal account as Rs 1,200.

(c)Goods withdrawn by proprietor for personal use Rs 1,000 were credited to sales account as Rs 1,600.

(d)Depreciation provided on machinery Rs 3,000 was posted to Machinery account as Rs 300.

(e)Sale of old car for Rs 10,000 was credited to sales account as Rs 6,000. Rectify the errors and prepare suspense account.

Answer :

|

Journal |

||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount |

||

|

(a) |

Suspense A/c |

Dr. |

11,000 |

|||

|

To Rajat |

5,000 |

|||||

|

To Kamal |

6,000 |

|||||

|

(Cash received from in the debit of |

||||||

|

(b) |

Salaries A/c |

Dr. |

2,000 |

|||

|

To Employee |

1,200 |

|||||

|

To Suspense A/c |

800 |

|||||

|

(Salaries paid to employee Employee’s Account as Rs |

||||||

|

(c) |

Sales A/c |

Dr. |

1,600 |

|||

|

To Suspense A/c |

600 |

|||||

|

To Purchases A/c |

1,000 |

|||||

|

(Goods drawn by proprietor wrongly credited to Sales |

||||||

|

(d) |

Suspense A/c |

Dr. |

2,700 |

|||

|

To Machinery A/c |

2,700 |

|||||

|

(Depreciation on machinery Rs to Machinery Account as |

||||||

|

(e) |

Sales A/c |

Dr. |

6,000 |

|||

|

Suspense A/c |

Dr. |

4,000 |

||||

|

To Car A/c |

10,000 |

|||||

|

(Sale of old car for Rs as Rs 6,000, now |

||||||

Q23 :Give journal entries to rectify the following errors assuming that suspense account had been opened.

(a)Goods distributed as free sample Rs 5,000 were not recorded in the books.

(b)Goods withdrawn for personal use by the proprietor Rs 2,000 were not recorded in the books.

(c)Bill receivable received from a debtor Rs 6,000 was not posted to his account.

(d)Total of Returns inwards book Rs 1,200 was posted to Returns outwards account.

(e)Discount allowed to Reema Rs 700 on receiving cash from her was recorded in the books as Rs 70.

Answer :

|

Journal |

||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

||||

|

(a) |

Advertisement |

Dr. |

5,000 |

|||||

|

To |

5,000 |

|||||||

|

(Goods now |

||||||||

|

(b) |

Drawings |

Dr. |

2,000 |

|||||

|

To |

2,000 |

|||||||

|

(Goods not |

||||||||

|

(c) |

Suspense |

Dr. |

6,000 |

|||||

|

To |

6,000 |

|||||||

|

(B/R now |

||||||||

|

(d) |

Return |

Dr. |

1,200 |

|||||

|

Return Outward |

Dr. |

1,200 |

||||||

|

To |

2,400 |

|||||||

|

(Total Return Outwards |

||||||||

|

(e) |

Discount |

Dr. |

630 |

|||||

|

To Reema |

Dr. |

630 |

||||||

|

(Discount Rs |

||||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(c) |

Debtors |

6,000 |

(d) |

Return |

1,200 |

||

|

Return |

1,200 |

||||||

|

Balance |

3,600 |

||||||

|

6,000 |

6,000 |

||||||

Q24 :Trial balance of Khatau did not agree. He put the difference to suspense account and discovered the following errors:

(a)Credit sales to Manas Rs 16,000 were recorded in the purchases book as Rs 10,000 and posted to the debit of Manas as Rs 1,000.

(b)Furniture purchased from Noor Rs 6,000 was recorded through purchases book as Rs 5,000 and posted to the debit of Noor Rs 2,000.

(c)Goods returned to Rai Rs 3,000 recorded through the Sales book as Rs 1,000.

(d)Old machinery sold for Rs 2,000 to Maneesh recorded through sales book as Rs 1,800 and posted to the credit of Manish as Rs 1,200.

(e)Total of Returns inwards book Rs 2,800 posted to Purchase account.

Rectify the above errors and prepare suspense account to ascertain the difference in trial balance.

Answer :

|

Journal |

|||||||||||

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

|||||||

|

(a) |

Suspense |

Dr. |

11,000 |

||||||||

|

Manas |

Dr. |

15,000 |

|||||||||

|

To Purchases A/c |

10,000 |

||||||||||

|

To Sales A/c |

16,000 |

||||||||||

|

(Goods Book as now |

|||||||||||

|

(b) |

Furniture |

Dr. |

6,000 |

||||||||

|

Suspense |

Dr. |

7,000 |

|||||||||

|

To Noor |

8,000 |

||||||||||

|

To Purchases A/c |

5,000 |

||||||||||

|

(Furniture Purchases Rs |

|||||||||||

|

(c) |

Sales |

Dr. |

1,000 |

||||||||

|

Rai A/c |

Dr. |

2,000 |

|||||||||

|

To Return Outwards A/c |

3,000 |

||||||||||

|

(Goods Sales |

|||||||||||

|

(d) |

Manish |

Dr. |

1,200 |

||||||||

|

Sales |

Dr. |

1,800 |

|||||||||

|

Maneesh A/c |

Dr. |

2,000 |

|||||||||

|

To Machinery A/c |

2,000 |

||||||||||

|

To Suspense A/c |

3,000 |

||||||||||

|

(Old the Account |

|||||||||||

|

(e) |

Return |

Dr. |

2,800 |

||||||||

|

To Purchases A/c |

2,800 |

||||||||||

|

(Total of Account, |

|||||||||||

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(a) |

Sales |

11,000 |

(d) |

Sundries |

|||

|

(b) |

Noor |

7,000 |

Maneesh) |

3,000 |

|||

|

Balance |

15,000 |

||||||

|

18,000 |

18,000 |

||||||

Q25 : Trial balance of John did not agree. He put the difference to suspense account and discovered the following errors :

(a)In the sales book for the month of January total of page 2 was carried forward to page 3 as Rs 1,000 instead of Rs 1,200 and total of page 6 was carried forward to page 7 as Rs 5,600 instead of Rs 5,000.

(b)Wages paid for installation of machinery Rs 500 was posted to wages account as Rs 50.

(c)Machinery purchased from R & Co. for Rs 10,000 on credit was entered in Purchase Book as Rs 6,000 and posted there from to R & Co. as Rs 1,000.

(d)Credit sales to Mohan Rs 5,000 were recorded in Purchases Book.

(e)Goods returned to Ram Rs 1,000 were recorded in Sales Book.

(f)Credit purchases from S & Co. for Rs 6,000 were recorded in sales book. However, S & Co. was correctly credited.

(g)Credit purchases from M & Co. Rs 6,000 were recorded in Sales Book as Rs 2,000 and posted there from to the credit of M & Co. as Rs 1,000.

(h)Credit sales to Raman Rs 4,000 posted to the credit of Raghvan as Rs 1,000.

(i)Bill receivable for Rs 1,600 from Noor was dishonoured and posted to debit of Allowances account.

(j)Cash paid to Mani Rs 5,000 against our acceptance was debited to Manu.

(k)Old furniture sold for Rs 3,000 was posted to Sales account as Rs 1,000.

(l)Depreciation provided on furniture Rs 800 was not posted.

(m)Material Rs 10,000 and wages Rs 3,000 were used for construction of building. No adjustment was made in the books.

Rectify the errors and prepare suspense to ascertain the difference in trial balance.

Answer :

|

S. No. |

Particulars |

L.F. |

Debit Amount Rs |

Credit Amount Rs |

||||

|

(a) |

Sales |

Dr. |

400 |

|||||

|

To |

400 |

|||||||

|

(Net now |

||||||||

|

(b) |

Machinery |

Dr. |

500 |

|||||

|

To |

50 |

|||||||

|

To |

450 |

|||||||

|

(Wages Rs 50 to |

||||||||

|

(c) |

Machinery |

Dr. |

10,000 |

|||||

|

Suspense |

Dr. |

5,000 |

||||||

|

To |

6,000 |

|||||||

|

To R |

9,000 |

|||||||

|

(Purchased to Purchases Book Account |

||||||||

|

(d) |

Mohan |

Dr. |

10,000 |

|||||

|

To |

5,000 |

|||||||

|

To |

5,000 |

|||||||

|

(Goods Purchases |

||||||||

|

(e) |

Sales |

Dr. |

1,000 |

|||||

|

To |

1,000 |

|||||||

|

(Goods now |

||||||||

|

(f) |

Purchases |

Dr. |

6,000 |

|||||

|

Sales |

6,000 |

|||||||

|

To |

12,000 |

|||||||

|

(Purchased Book; now |

||||||||

|

(g) |

Purchases |

Dr. |

6,000 |

|||||

|

Sales |

Dr. |

2,000 |

||||||

|

To M |

5,000 |

|||||||

|

To |

3,000 |

|||||||

|

(Purchased in as Rs 1,000, |

||||||||

|

(h) |

Raman |

Dr. |

4,000 |

|||||

|

Raghvan |

Dr. |

1,000 |

||||||

|

To |

5,000 |

|||||||

|

(Sold of Raghavan’s Account as Rs 1,000, now rectified) |

||||||||

|

(i) |

Noor A/c |

Dr. |

1,600 |

|||||

|

To |

1,600 |

|||||||

|

(B/R dishonoured, which was received from Noor, wrongly now |

||||||||

|

(j) |

Bills |

Dr. |

5,000 |

|||||

|

To Manu |

5,000 |

|||||||

|

(Amount Manu’s Account, |

||||||||

|

(k) |

Sales |

Dr. |

1,000 |

|||||

|

Suspense |

Dr. |

2,000 |

||||||

|

To |

3,000 |

|||||||

|

(Old Sales |

||||||||

|

(l) |

Depreciation |

Dr. |

800 |

|||||

|

To |

800 |

|||||||

|

(Depreciation |

||||||||

|

(m) |

Building |

Dr. |

13,000 |

|||||

|

To |

10,000 |

|||||||

|

To |

3,000 |

|||||||

|

(Material construction |

||||||||

Note: In item (m), it has been assumed that the materials used in the construction of building are part of stock in trade.

|

Suspense Account |

|||||||

|

Dr. |

Cr. |

||||||

|

S. No. |

Particulars |

J.F. |

Amount Rs |

S. No. |

Particulars |

J.F. |

Amount Rs |

|

(c) |

Purchases |

5,000 |

(a) |

Sales |

400 |

||

|

(k) |

Furniture |

2,000 |

(b) |

Machinery |

450 |

||

|

(f) |

Purchases |

6,000 |

|||||

|

Sales |

6,000 |

||||||

|

(g) |

Purchases |

3,000 |

|||||

|

(h) |

Raman |

4,000 |

|||||

|

Balance |

13,850 |

Raghvan |

1,000 |

||||

|

20,850 |

20,850 |

||||||